estate tax changes build back better

Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

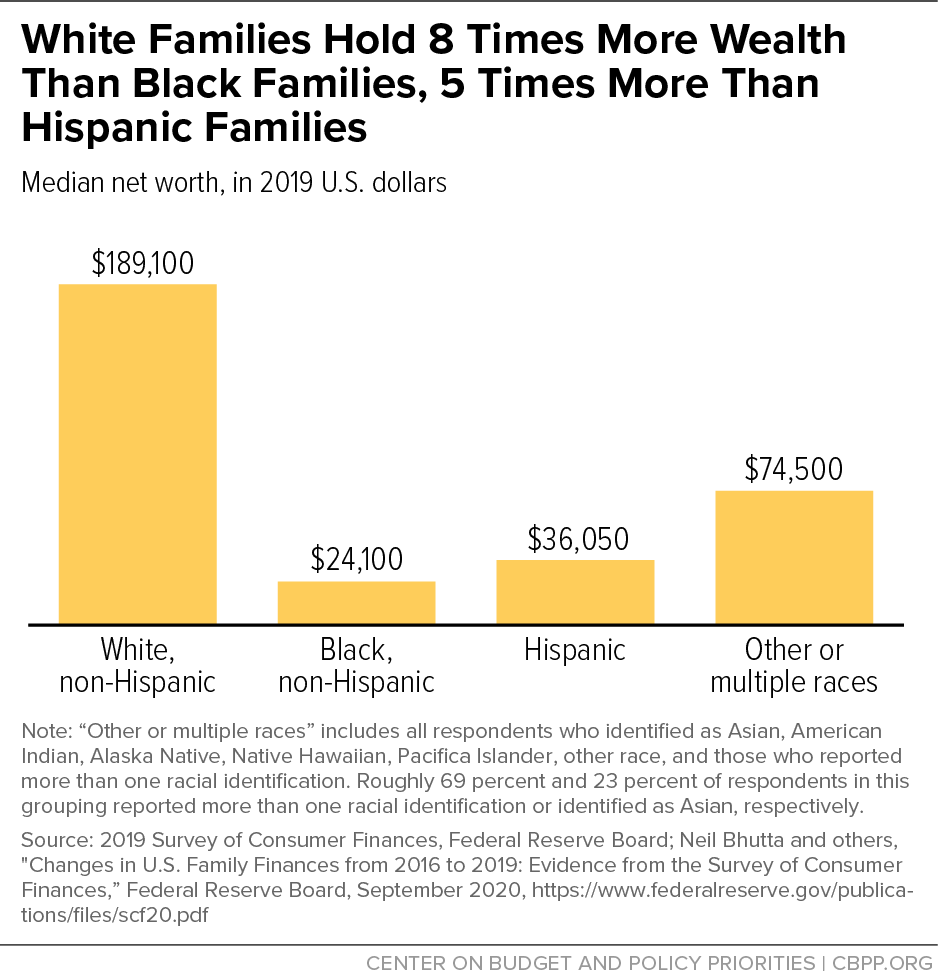

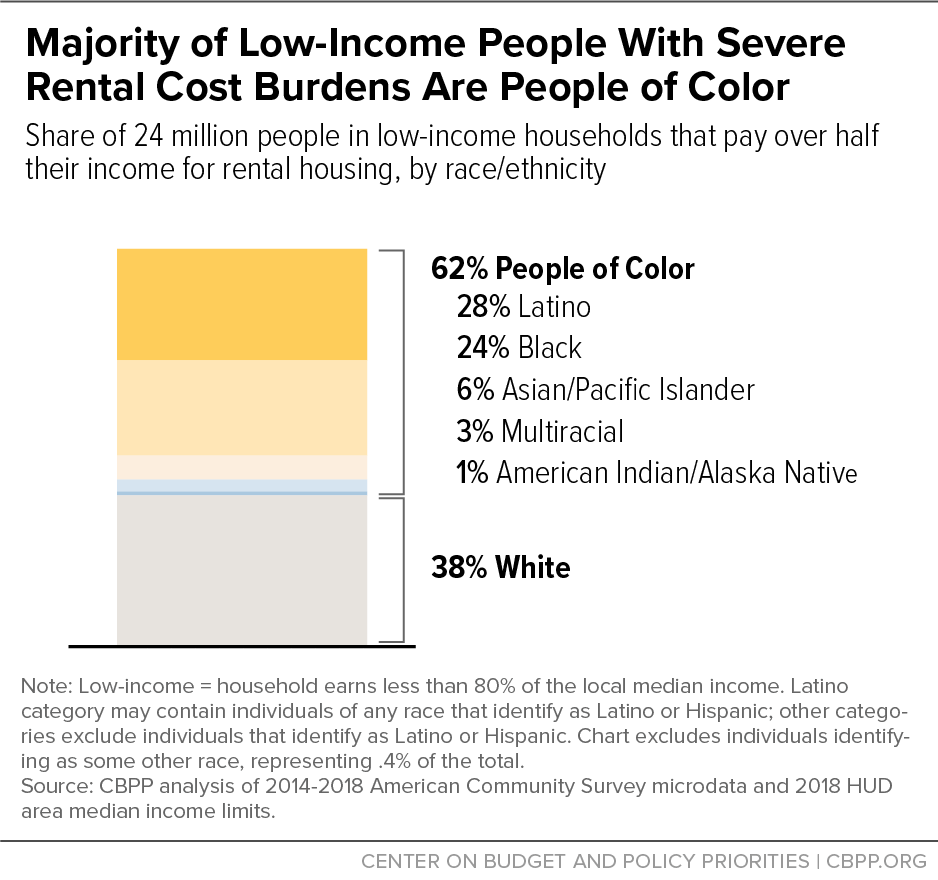

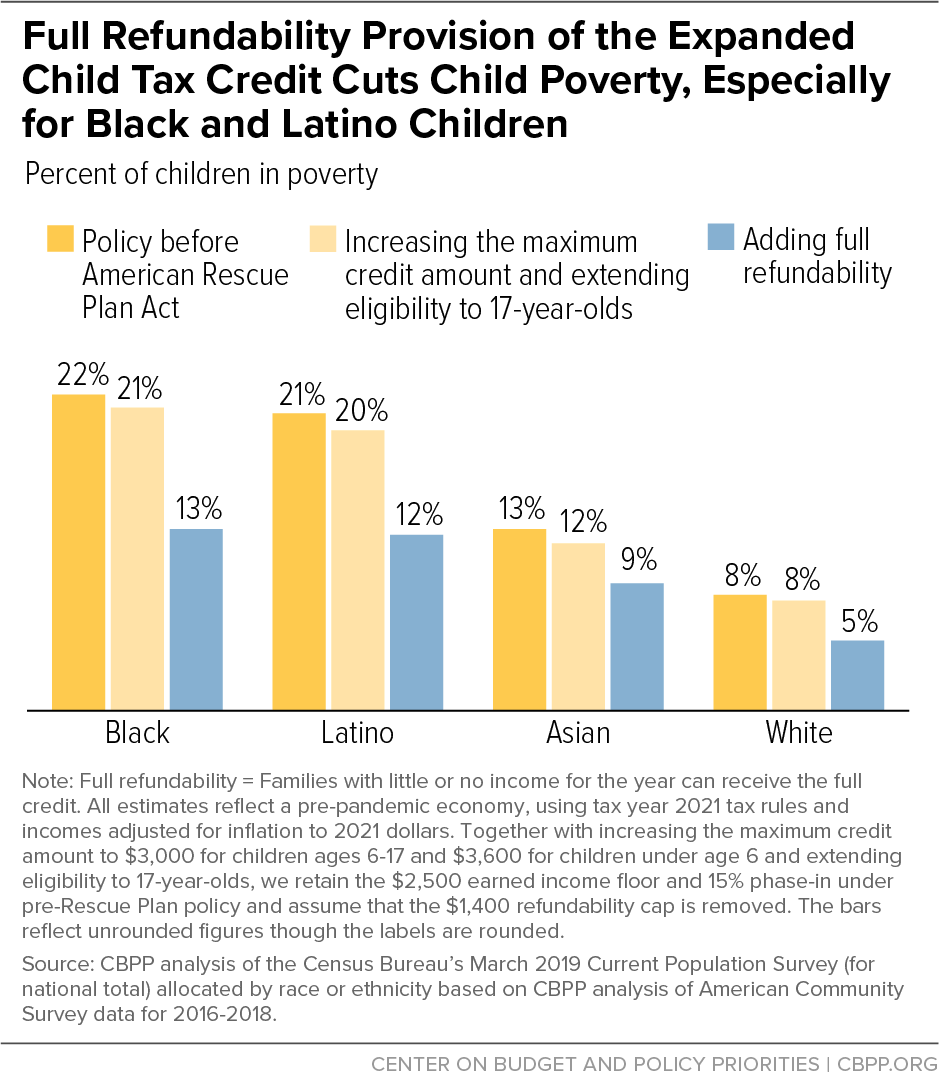

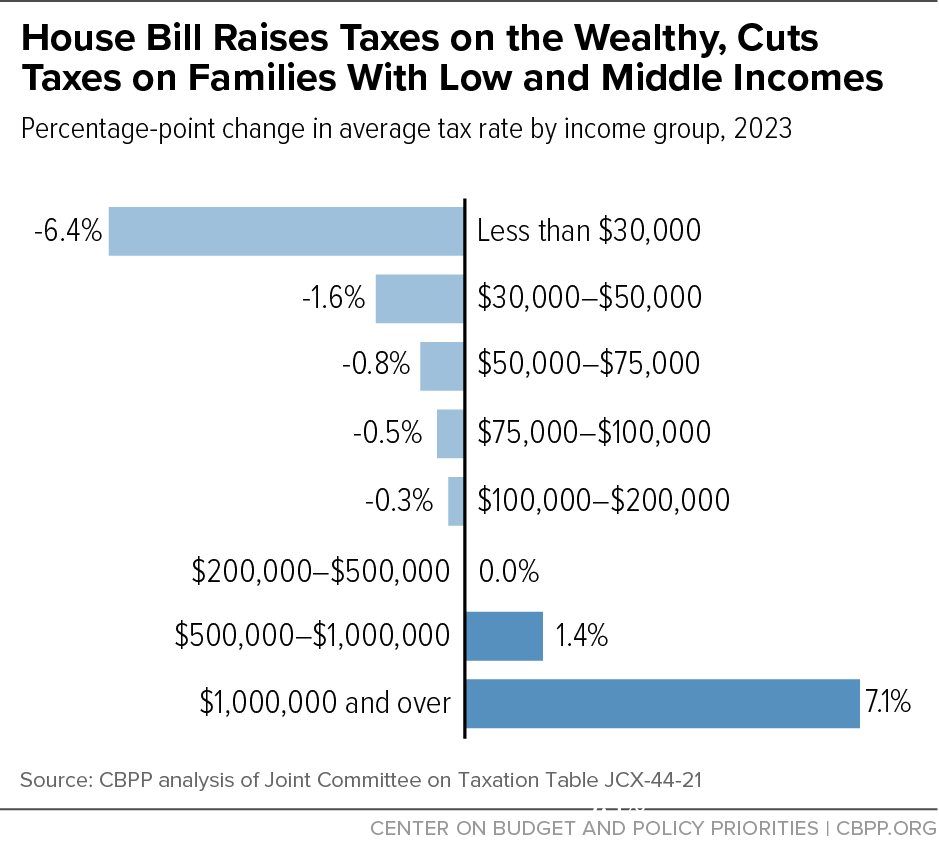

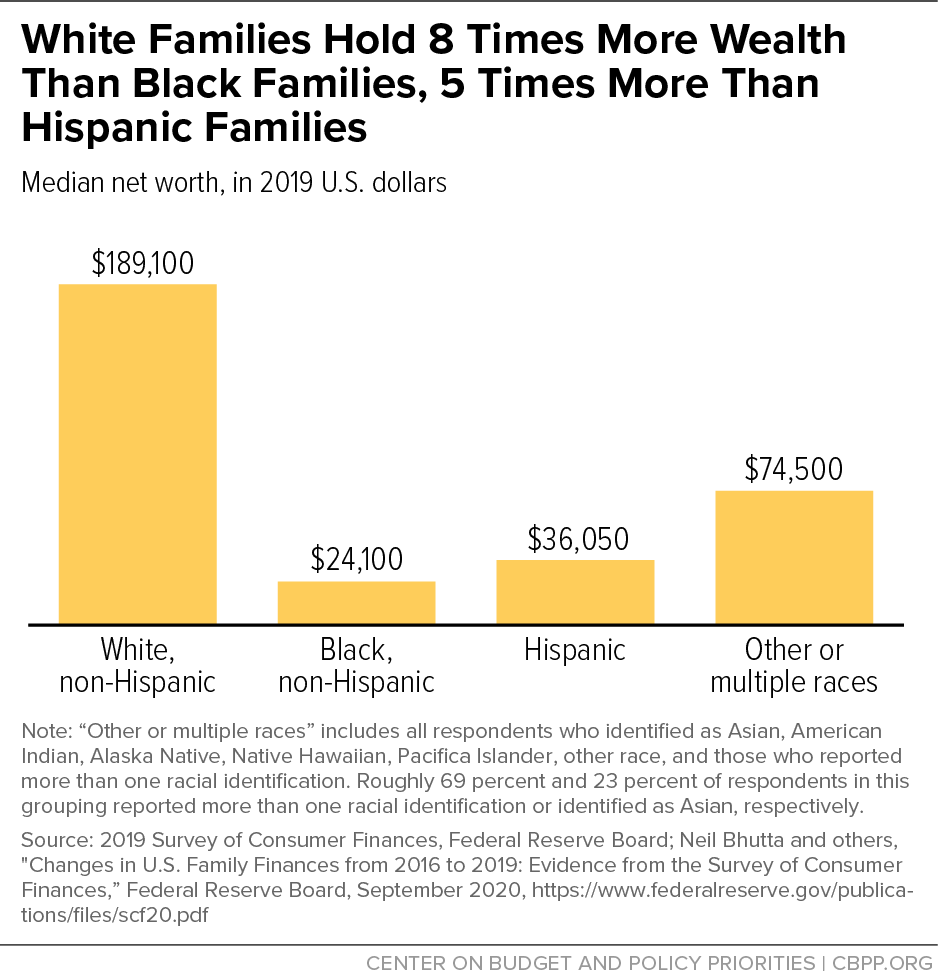

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Adding in 207 billion of nonscored revenue that is estimated to.

. There are very few tax provisions in the act. Lowering the gift and estate tax exemptions seems a lock. Build Back Better Act and Estate Planning Changes.

The AICPA told Congress about our concerns with the. Economic Effects of the Updated House Build Back Better Act For purposes of estimating the bills impact on federal budget deficits interest payments and resulting. The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in. A notable exception is the early Sept. The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years.

Our tax expert weighs in. 5376 would revise the estate and gift tax and treatment of trusts. The BBBA proposal seeks to reduce these.

President Bidens Build Back Better Act has made a significant first. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. The upshot is to avoid these new grantor trust tax rules create and fully fund your grantor trust by the end of 2021.

Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. 3 version introduced an increase to the cap with a slightly higher. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1 2022. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments. The estate planning community got some very good news on October 28 2021 when the Biden administration released its Framework for the Build Back Better Act.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. 28 2021 President Joe Biden announced a framework for changes to the US. Gift and Estate Taxes Proposed Under the Build Back Better Act.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. In late October the House Rules Committee released a revised. 30 sunset of the Employee Retention Credit ERC.

Understanding Other Proposed Changes Under the Build Back. Build Back Better Act and Estate Planning Changes. These proposals are currently under.

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

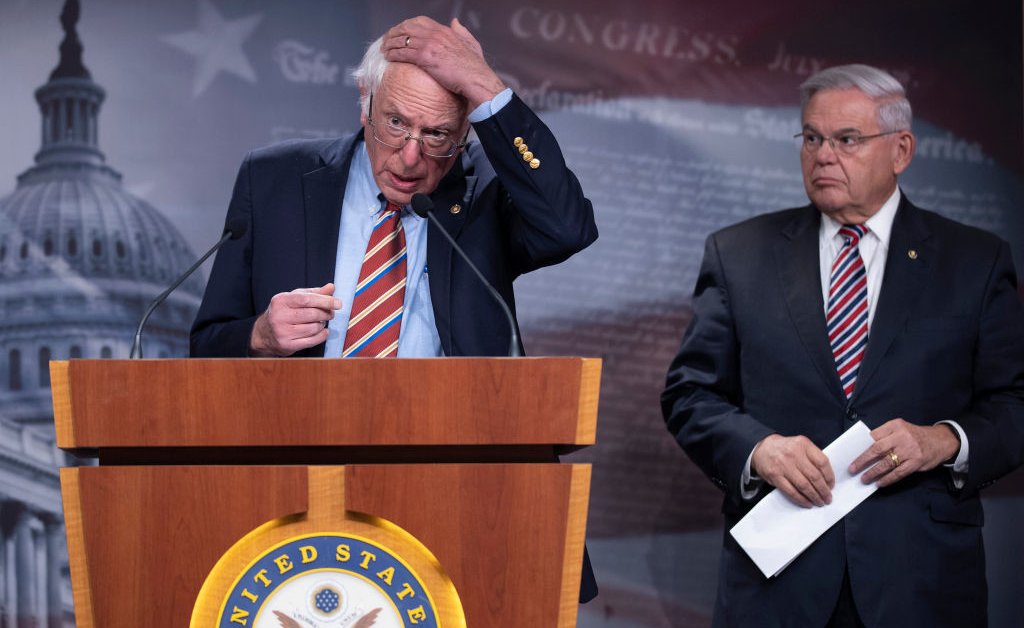

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

Whatever This Is It Won T Be Build Back Better

Why This Tax Provision Puts Democrats In A Tough Place Time

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

How Build Back Better Would Impact Housing Forbes Advisor

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

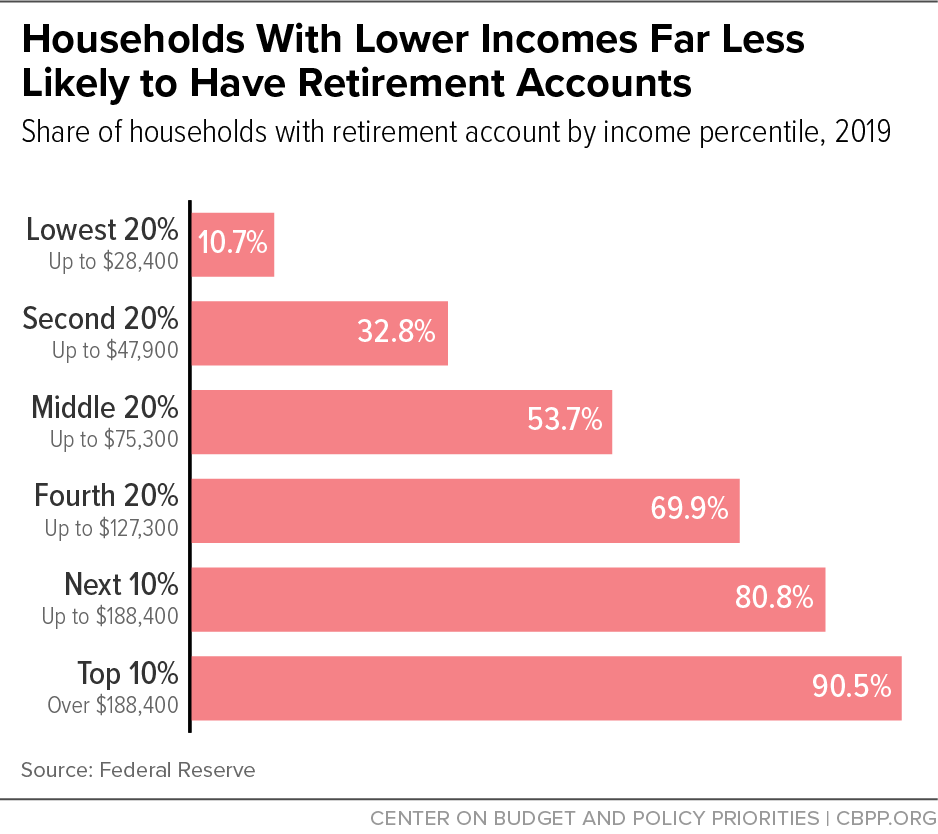

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Biden Announces 2 Trillion Climate Plan The New York Times

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Biden Budget Biden Tax Increases Details Analysis

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

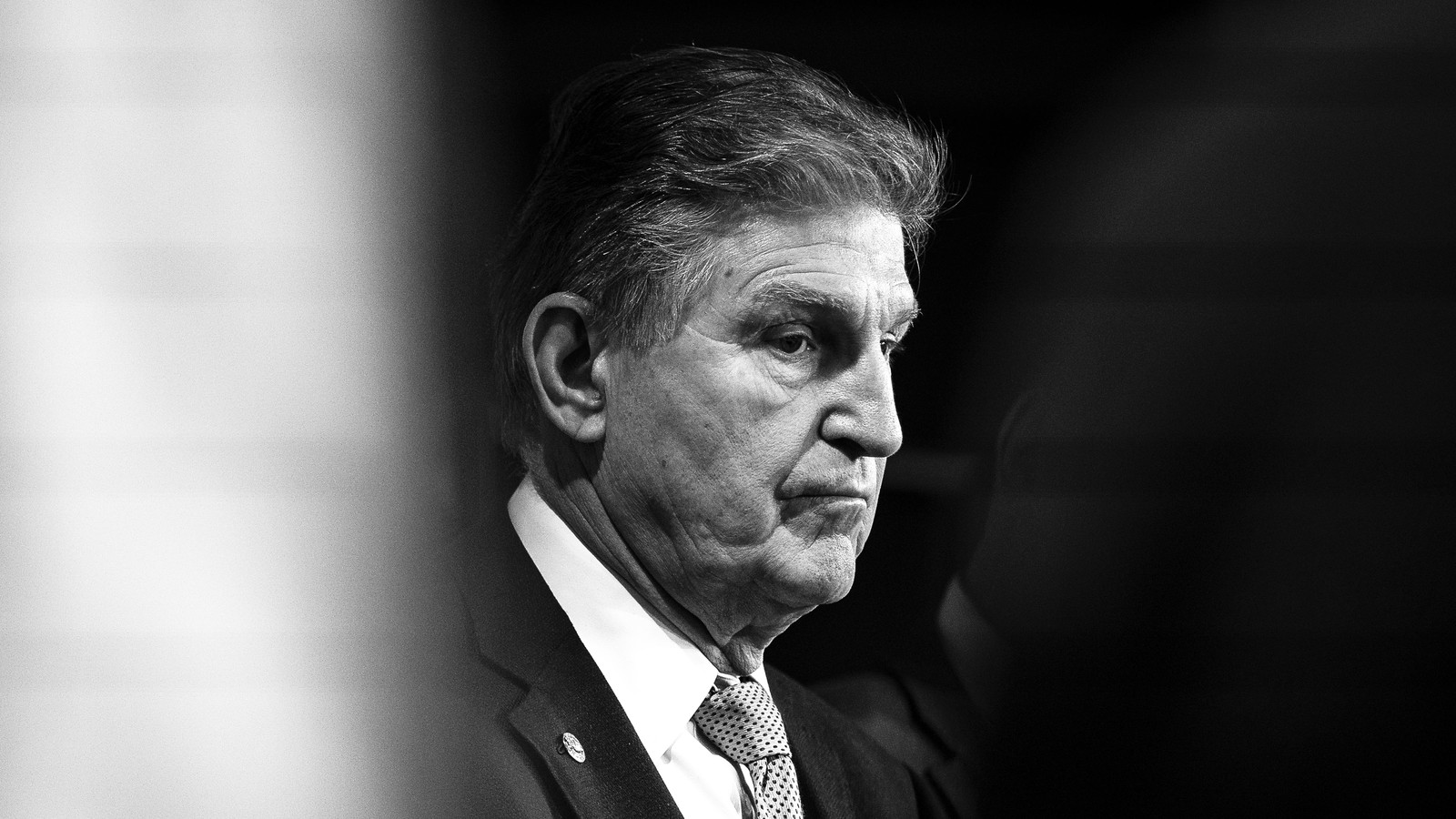

Biden Pledges Executive Action After Joe Manchin Scuppers Climate Agenda Joe Manchin The Guardian

Expanding The Net Investment Tax Mostly Would Target Households Making 1 Million Or More

Tpwd Agriculture Property Tax Conversion For Wildlife Management In 2022 Wildlife Agricultural Land Management